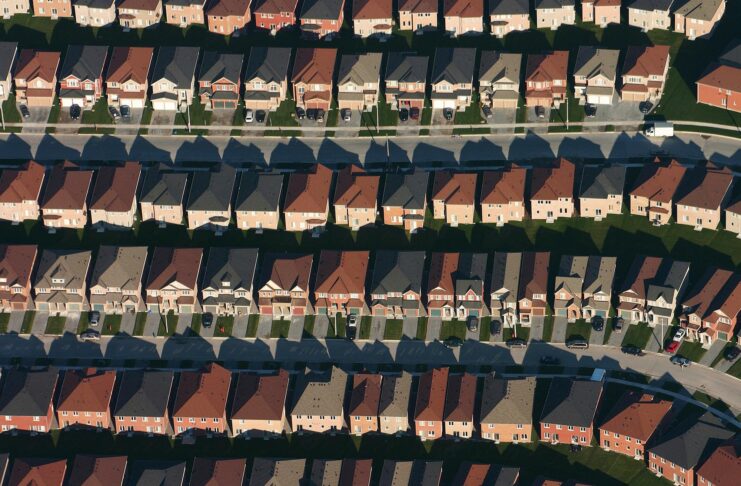

The continual rise of mortgage rates in the U.S. is increasingly pricing out many American families from the world of homeownership.

February 2022 saw pending home sales decline by more than 4%, making it the fourth consecutive month of slowed pending house sale numbers. As home sales in America slide, one number that continues to rise is the average mortgage and refinancing rate, with current levels showing a medium increase of 20% when compared to just last year.

Last Tuesday, mortgage rates spiked by a 26-point jump from the level they were on March 18th, largely due to a similar spike in the 10-year U.S. Treasury yield. But as the Federal Reserve scales back its holdings of mortgage-backed bonds and raises interest rates, there appears to be little respite coming to the wallets of American homeowners.

This latest sign of an economic downturn comes at a time when consumers are feeling the pinch across the board. Gas prices have steadily been rising since 2021, and as President Biden and the White House continue to refuse the idea of reopening American oil production plants, those increased costs appear set to only rise in the coming months. According to AAA, the average cost of a gallon of gas is now $4.24, with some places in California reporting prices as high as $6. While this number is down slightly from the high on March 11th, when regular gas reached its highest ever recorded average price of $4.33 per gallon, it is still far off from where it was a year ago at $2.86. (RELATED: Under Joe Biden, America is Running Out of Gas)

As the cost of living closes in on American consumers, producers' prices are rising and business is slowing, especially in the housing market. George Ratiu, Manager of Economic Research at realtor.com, states that “With mortgage rates moving toward 5%, we are seeing early signs of a shift in housing fundamentals, as many people looking for a home have hit a ceiling on their ability to afford a home.” (RELATED: Former Obama Advisor Explains Why Biden Has Only Himself to Blame for Thursday's Inflation Report)

At the beginning of the month, President Biden took to the floor of the United States House of Representatives to deliver his State of the Union address to the nation. During his address, he stated “But with all the bright spots in our economy, record job growth, higher wages, too many families are struggling to keep up with the bills. Inflation is robbing them of the gains they thought otherwise they would be able to feel. I get it. That's why my top priority is getting prices under control.” But, ultimately, President Biden has failed to do so, with prices showing no signs of slowing down.

As the 2022 midterm election season approaches, more Americans than ever will be considering the sharp increase in inflation and poor economic performance seen under the first two years of the Biden presidency. Things aren't looking good for the president or the Democrat Party, as a Reuters poll released last week revealed that the president's approval rating had fallen to a new low of just 40%. With only a thin majority holding onto the reins of power in Congress, the White House should be concerned that the same poll also reflected that respondents ranked the economy as their number one concern. (RELATED: House Republicans Push Ambitious Midterm Strategy)

The opinions expressed in this article are those of the author and do not necessarily reflect the positions of American Liberty News.